-

DeutschDeutschland

-

EnglishWorldwide

-

Canada

-

Ireland

-

South Africa

-

United Kingdom

-

EspañolArgentina

-

Colombia

-

España

-

FrançaisFrance

-

Tunisie

-

Magyar nyelvMagyarország

-

NederlandsNederland

-

PolskiPolska

-

SuomiSuomi

| Class of shares | no-par bearer shares |

| Capital stock | 9,220,893 € |

| Shares Outstanding | 9,220,893 |

| WKN / ISIN | 576002 / DE0005760029 |

| Stock exchange | Xetra, free trade Munich (m:access) and other German stock exchanges |

| Industry | Renewable Energy |

| Accounting regime | German Commercial Code (HGB) |

| Fiscal year-end | December 31st |

| Bloomberg-code | AB9:GR |

| Reuters-code | AB9.D |

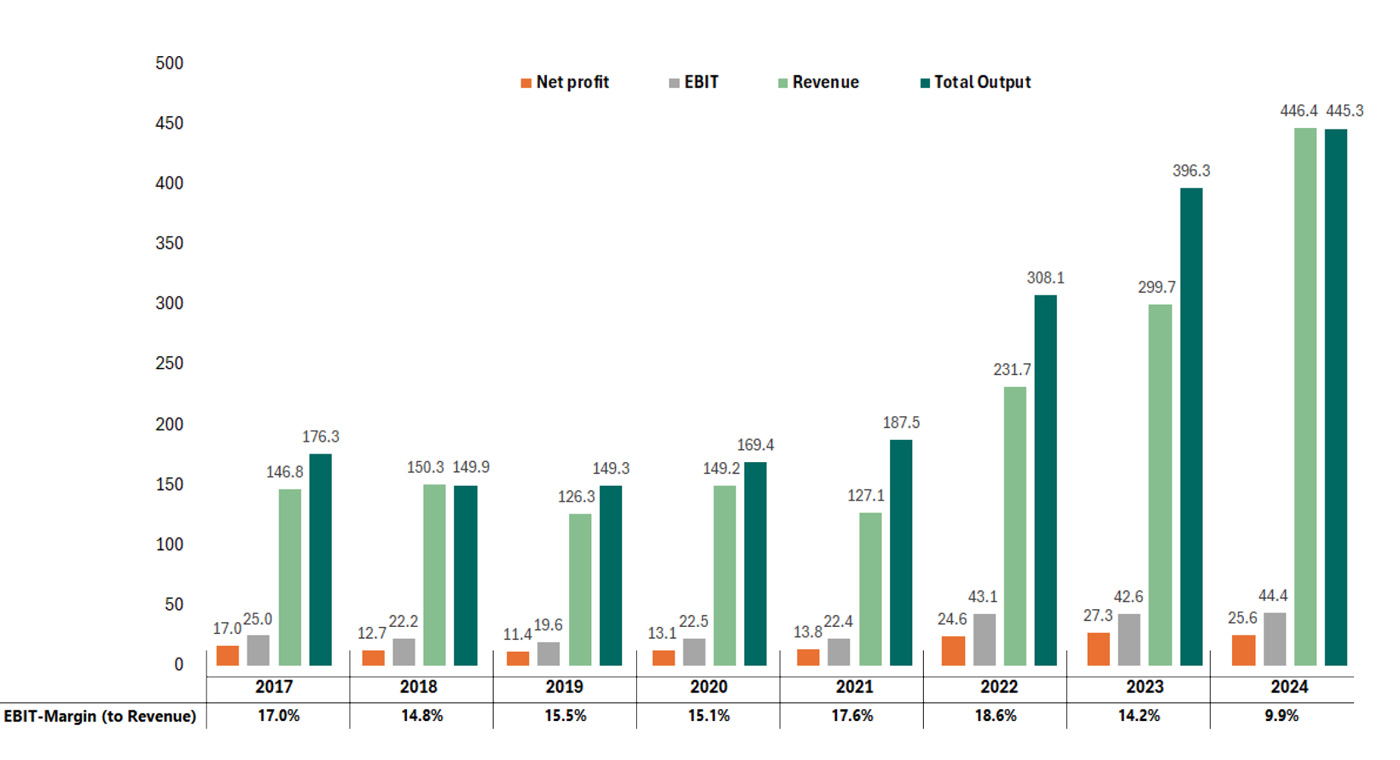

Since its foundation in 1996, the company has always reported positive figures. In 2016, the annual net profit exceeded the ten-million-euro mark for the first time. In the years that followed, the group always achieved net profits in the double-digit million-euro range. In 2022, the threshold of 20 million euros was exceeded for the first time. This level should also be maintained in the coming financial years. This expectation is based on the fact that more renewable energy parks in the planning phase are ready for construction and can thus be exploited economically (overview projects in development).

| (EUR) | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| EBITDA | 4.94 | 4.24 | 3.43 | 3.77 | 3.31 | 6.18 | 6.44 | 7.11 |

| Net Profit | 2.22 | 1.67 | 1.41 | 1.42 | 1.50 | 2.67 | 2.95 | 2.77 |

| Dividend | 0.40 | 0.42 | 0.42 | 0.45 |

0.49 |

0.54 | 0.60 | 0.65* |

| Book value (as of 31.12) | 10.4 | 11.64 | 12.83 | 15.20 | 16.25 | 18.4 | 20.91 | 23.1 |

| Share price (as of 31.12) | 12.0 | 13.80 | 17.30 | 46.40 | 55.8 | 74.20 | 41.10 | 36.10 |

| Price-earnings ratio | 5.4 | 8.28 | 12.27 | 32.7 | 37.2 | 27.8 | 13.9 | 13.0 |

| (EUR million) | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Total assets | 174.0 | 194.0 | 242.8 | 249.3 | 296.6 | 451.3 | 493.1 | 656.5 |

| Equity | 79.6 | 89.0 | 103.6 | 140.1 | 149.9 | 170.1 | 192.8 | 212.8 |

| Date (expected) | Release / Event |

| June 22, 2026 | Annual Report 2025 |

| June, 23, 2026 | Investor- and Analyst Call: FY 2025 Results |

| August 13, 2026 | Annual General Meeting, IHK Wiesbaden |

| September 1, 2026 | Half Year Report 2026 |

| November 23-25, 2026 | Deutsches Eigenkapitalforum Frankfurt (capital market conference) |

| Date | Event | Presentation |

|---|---|---|

| 01.04.2025 | Earnings Call 2024 | 2025 04 01 ABO Energy Earnings Call (youtube.com) |

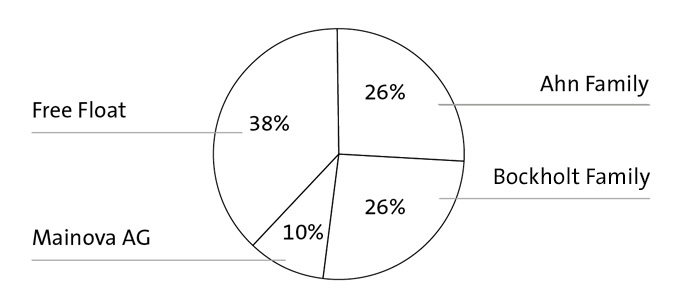

The families of Matthias Bockholt und Dr. Jochen Ahn, both founders, each hold approximately 26 percent of the shares. Both have divided their share among their spouse and three children. None of these ten shareholders owns more than 9 percent of the shares.

Thus, the largest single shareholder is Mainova AG, an energy supplier based in Frankfurt/Main, owning approximately ten percent of the shares. To the Company's knowledge, no other shareholder holds more than three percent of the shares.

Unlike the regulated market, investors in over-the-counter trading are not legally obligated to report when their voting rights cross a certain threshold. Only if another company owns more than 25 percent of the shares, it has to inform the company. Thus ABO Energy does not have a secured overview of their shareholders or the number of shares they hold.

Company

ABO Energy was founded in 1996 by Dr. Jochen Ahn and Matthias Bockholt.

ABO Energy plans and builds wind, solar, battery and hydrogen projects worldwide. In doing so, we concentrate on project development and construction. ABO Energy does not hold an own portfolio of parks.

All information and reasons for the name change can be found here >

You can find our current management team here >

You can find our current Supervisory Board members here >

A worldwide project overview can be found here >

All information on ESG and sustainability can be found here >

ABO Energy aims to generate a net profit of €50m in 2027. Further guidance on our financial targets can be found in our Investor Relations presentation >

Share

The stock trades under the ISIN: DE0005760029 and WKN: 576002

The current shareholder structure can be found here >

All relevant data can be found here >

All information about ABO Energy and the Equity Story can be found in our Investor Relations presentation >

Dates & Reports

The next Annual General Meeting has taken place on May 27, 2025 at the Wiesbaden Chamber of Industry and Commerce (IHK). You can find all related documents and voting results here: Hauptversammlung der ABO Energy KGaA.

The most important dates for 2025 can be found here >

A video conference for analysts and investors to present the 2024 financial figures is planned for April 1, 2025.

You can find our annual reports here >

The current analyst reports can be found here >

| Year |

Event |

Capital stock in EUR |

| 2000 | Foundation of ABO Wind AG through conversion from Ahn & Bockholt Planungsgesellschaft mbH |

200,000 |

| 2001 | Capital increase by issuing 50,000 new shares at a unit price of 20 euros. Issue proceeds: 1,000,000 euros |

250,000 |

| 2002 | Capital increase from company funds (shareholders receive one new share for one old share) |

500,000 |

| 2003 | Capital increase from company funds (shareholders receive one new share for one old share) |

1,000,000 |

| 2006 | Capital increase from company funds (shareholders receive one new share for one old share) |

2,000,000 |

| 2011 | Capital increase by issuing 151,000 new shares at a unit price of 9.50 euros. Issue proceeds: 1,434,500 euros |

2,151,000 |

| 2012 | Capital increase by issuing 239,000 new shares at a unit price of 31.50 euros. Issue proceeds: 7,528,500 euros |

2,390,000 |

| 2012 | Capital increase from company funds (Shareholders receive two new shares for one old share) |

7,170,000 |

|

2012 |

Capital increase by issuing 400,000 new shares at a unit price of 10.50 euros. Issue proceeds: 4,200,000 euros |

7,570,000 |

| 2013 | Capital increase by issuing 75,700 new shares at a unit price of 10.50 euros. Issue proceeds: 794,850 euros |

7,645,700 |

| 2019 | Capital increase by issuing 425,193 new shares from conditional capital at a conversion price of 15 euros. Issue proceeds: 6,377,895 euros |

8,070,893 |

| 2020 | January: Capital increase by issuing 400,000 new shares at a unit price of 17.10 euros. Issue proceeds: 6,840,000 euros |

8,470,893 |

| 2020 | July: Capital increase by issuing 200,000 new shares at a unit price of 20.40 euros. Issue proceeds: 4,080,000 euros |

8,670,893 |

| 2020 | November: Capital increase by issuing 550,000 new shares at a unit price of 29.50 euros. Issue proceeds: 16,225,000 euros |

9,220,893 |